Bitmain Antminer E9 My Thoughts

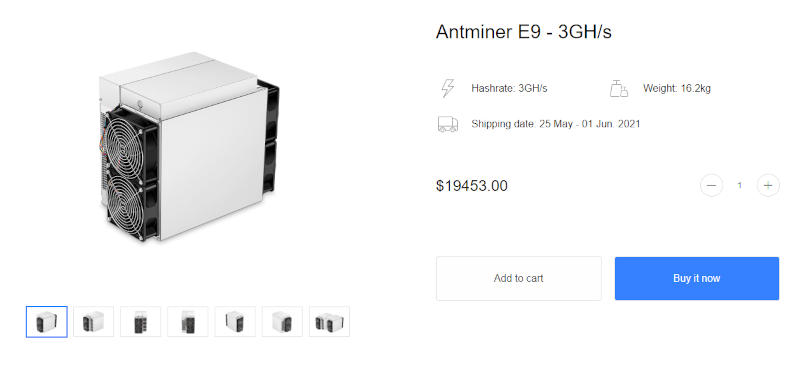

So Ethereum ASIC miners have been around for a while now. Some with impressive hash rates and some without. The newly released Bitmain Antimer E9 claims 3,000 MH/s with the Ethereum Ethash algorithm. That's quite impressive! Especially when teamed up with the estimated power usage of 2,550 watts. That gives you an estimated 1,176 KH/j, which is more than twice what the best GPU mining rigs can do. But don't rush for your credit card just yet. I've seen this play out many many times before. Bitmain isn't telling you everything.

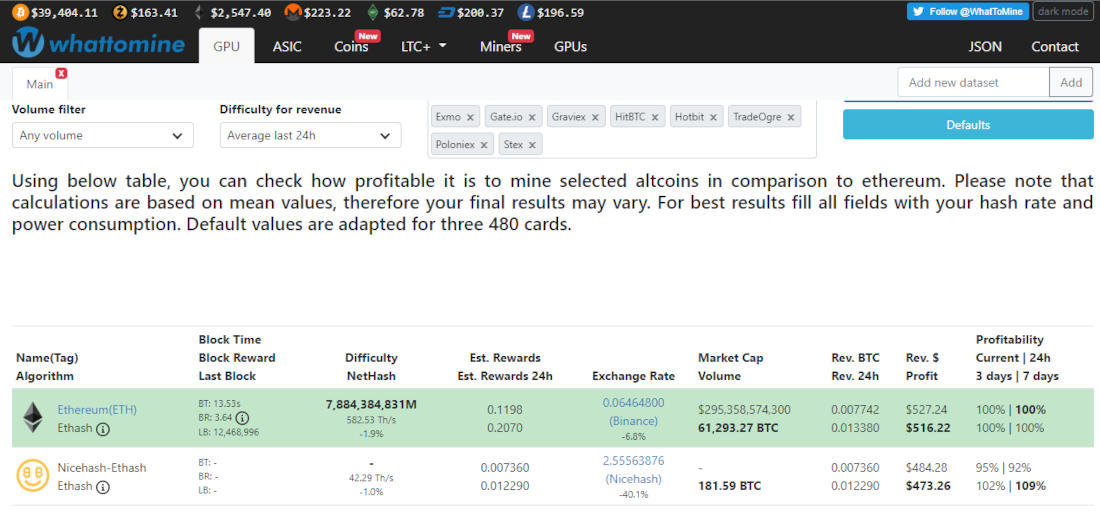

The problem with ASIC miners is everyone can have one. If you were to get hold of some of these and no one else could, it would be happy days. But Bitmain is in the market of making hardware and making a good profit off that hardware. The development cost for the chips in ASIC miners is significant. So to make it worth while Bitmain would expect to ship thousands of these units. When that does happen there will be a significant amount of hash power being added to the Ethereum network. And what does the network do in response? It increases the difficulty of course. And increased difficulty means less rewards per unit of hash power. So your profits will reduce when mining Ethash, and the same will be true for everyone who just bought a USD $20k Antminer E9. This will happen pretty quickly as the network is trying to preserve the block time. So when you put your numbers into https://whattomine.com/ and it shows you the below, you're pretty excited right? Payback in under two months! Unfortunately, that's not going to happen. The network will make sure it doesn't if it's operating properly.

No Flexibility

Well if the profitability gets eroded you can just switch to another coin right? Wrong. This machine is made from the ground up to mine Ethereum with the Ethash algorithm, which is specific to the Ethereum network. You will probably see developers making custom images and firmware for this miner in the future because there are other similar algorithms it could probably mine, like Etchash (Ethereum Classic) but that has an issue with warranty being void and moving the problem onto the Ethereum Classic network. You are pretty much going to be stuck mining Ethereum untill it moves from Proof of Work (POW) to Proof of Stake (POS). And then your Antminer E9 might not be worth much. You don't have the same problem with a GPU mining rig.

Longevity

When the Ethereum network is saturated with Antminer E9's the profitability will reduce and at some point in the future as mentioned above Ethereum is moving to POS. So how long will this miner be useful? If the profits keep getting eroded how long will it take to get your money back? Will you even be able to break even before things get dire or Ethereum isn't mineable any more? Who knows. You don't have this issue with GPU mining rigs.

Resale Value

So you have an Antminer E9 and you've milked all you can out of the Ethereum network, and you're looking to offload it to someone else on eBay. Perahps you'll do a quick search for what they're selling for now and how many listings there are. Don't be surprised to see hundreds of listings and prices at bargain basement levels. If you can't make money out of this miner anymore, nor can anyone else. And it's only worth what it can make. I wouldn't be surprised to be able to pick one of these up for $1,000 in about 2 years time. Someone email me, its currently (May 2021).

The Verdict : If you want good flexibility, longevity and resale value for your hardware steer clear of ASIC miners.

Next : NVidia LHR Cards Explained By

By